It struck me in reading a number of comments recently that people aren't exactly seeing camera pricing correctly. Part of that has to do with on and off again instant rebates and older generation bodies still littering the market.

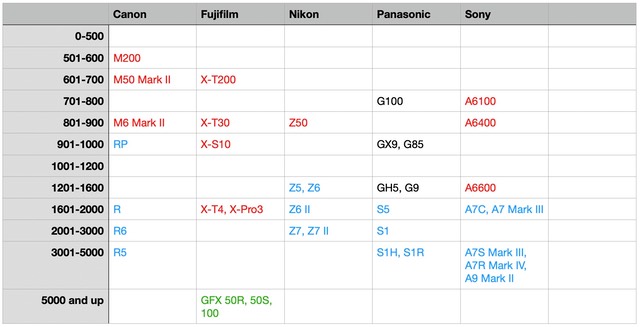

Since we're in a period of relative quiet in terms of rebates at the moment, I thought it might be wise to show where things really are in terms of current model mirrorless camera pricing and make a few comments about that. Here's what I see today (ignoring a few Panasonic instant rebates still in effect):

Black = m4/3, Red = APS-C, Blue = Full Frame, Green = Medium Format

I've left out OM Digital Solutions for the moment, as it's unclear what will be happening even short term with them. Moreover, as part of the transition, there was a temporary change from subsidiary to distributor that's still skewing immediate pricing.

In terms of the Big 3 (Canon, Nikon, Sony), it's actually quite interesting. Canon is skewed lower in price (other than the R5/R6), Sony is skewed higher in price (three models above US$3000), and Nikon is somewhere more in the middle. Nikon's "middle" is skewed high middle, though.

Meanwhile, the challenge for Fujifilm is to compete against Canon and Sony in crop sensor, but Fujifilm's top models actually price out higher than entry full frame. Sony is using crop sensor to protect the <US$1600 camera market. The Panasonic G's other than perhaps the GH5 all seem a bit too high-priced to me (though many are on discount at the moment still, probably because they don't sell at list price against that larger sensor competition).

The mirrorless camera market has been flat in volume for the last four years, stuck within spitting distance of 4m units/year. Thus, any loss of market share (Fujifilm, Panasonic, and Sony all have had some during that period) is not a sign that your strategy is compelling against the competition. Indeed, I'm not sure any of the camera maker's strategy at the moment is truly compelling: as I noted many years ago, we have more players fighting in the smaller pool than ever before. (DSLR was the bigger pool until this year, and it had only two viable competitors.)

Some things to note:

- There's a big gap in the Canon full frame pricing. I fully expect Canon to fill that gap.

- Nikon's full frame is tightly grouped. I expect them to move higher, and maybe lower, by expanding the lineup.

- Sony's full frame lineup has a strange gap in the US$2000-3000 range. I expect them to spread their models a bit better in the future.

- APS-C is US$500 to US$2000. I'm not convinced that the two ends of that range are going to be long-term productive. Sony is better positioned than Canon and Fujifilm if I'm correct.