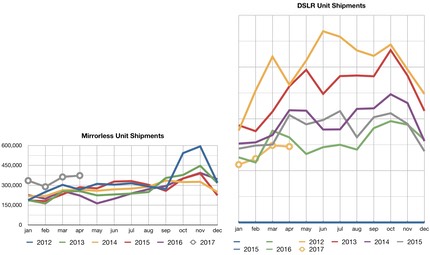

I’m amused by the various articles citing the latest CIPA statistics. Most seem to only be pointing out that the April interchangeable lens camera (ILC) shipments have shown a slight increase from last year. Here’s the full chart I usually publish:

Mirrorless is clearly trending higher than last year in shipments, DSLRs lower.

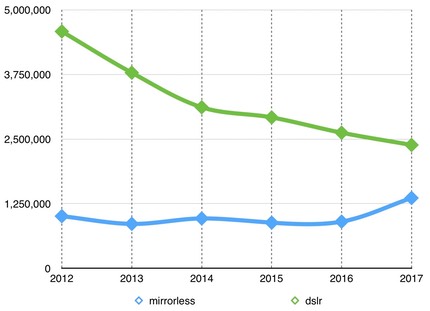

As I’ve long tried to point out, it is longer-term analyses that are more important to look at. But even then things aren’t always exactly what they seem. For instance, if we plot the first four months of 2017 versus the first four months of previous years, we get this:

I saw someone comment about that “oh boy, mirrorless is going to surpass DSLR next year.”

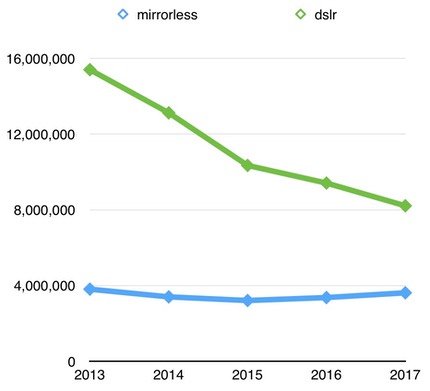

Well, maybe. But probably not. Let’s instead do a 12-month trailing analysis. In other words, here are the mirrorless and DSLR shipments from May of a previous year to April of the stated year:

Wait, what? Mirrorless is flat?

Yes, in general we’d have to conclude that’s mostly true for the moment. One month, two month, three month, or even four month tracking is still fairly susceptible to new product introductions and other minor things that can cause spikes or troughs.

My own assessment is that mirrorless may come close to equalling its best year to date. There’s a possibility it might even exceed it. But it’s still a fairly flat market with a lot of players in it fighting for market share.

What we can easily conclude from a long-term look at CIPA numbers at this point is that DSLR sales are on a fairly consistent decline year-over-year with no end in sight. For Canon and Nikon to maintain their ILC duopoly long-term, therefore, they’re going to have to step up their mirrorless action, and soon.

As much as the EOS M5/6 picked up significant mirrorless market share for Canon, they’ll need to do even more in the future if they want to keep 45%+ of the ILC market. Think of the EOS M5 as the first useful and significant mirrorless Rebel, and then imagine how Canon has to add the higher models to mirrorless in the coming months/years as DSLRs continue to decline.

Nikon is in the same situation, only worse. While Canon has now proven that they can muscle into the mirrorless market, Nikon has been strangely silent with the Nikon 1, and nothing new seems to be about to pop onto the scene from them. They, too, need a useful and significant mirrorless product, and then to develop that out to supplement and eventually replace their DSLRs.

The real issue for both Canon and Nikon is whether the legacy glass investment by customers can still be leveraged.

In particular, Canon should be worried about the Sony A7/A9 models, as it’s been proven that some EF lens adapters actually work usefully on those cameras, if not completely or perfectly. That makes it somewhat easy for Canon DSLR folk to slide over to Sony FE mirrorless with little penalty. The question then becomes whether those people like what they got in the Sony and start buying Sony FE lenses. Too much of that, and Canon’s legacy advantage basically falls apart.

Nikon’s not quite in as bad a shape here, as even third-party Nikon F-mount lens makers have a hard time getting full compatibility with the DSLRs. To date, the mirrorless adapters for Nikon lenses have been pretty pathetic. They work best with old AI manual focus lenses with an aperture ring, which isn’t exactly where the mainstream is for Nikon these days.

Still, Nikon can’t sit on their hands (or the Nikon 1) for very much longer. That downward slope on the DSLR numbers has to have top management in the Shinagawa Intercity Tower trembling without any evident quake in the region. Everyone in Tochigi should be worried, too, as you really need lots of bodies being sold in order to fuel the lens business.

My bet is that the mirrorless market looks far different 18 months from now than it does today. I can’t imagine Canon and Nikon waiting any longer than that to try to put their full muscle into the market.

Personally, I can’t wait for that to happen, because it’ll mean we have a full group of companies actively competing against one another aggressively. Competition is good.