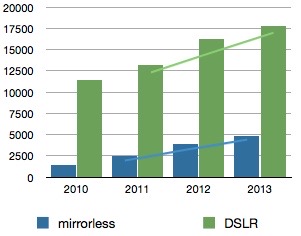

As part of the Panasonic GF6 announcement, they talked briefly about market and strategy at some of the regional rollouts. Here are Panasonic's overall market numbers re-graphed:

I've added a moving average line to illustrate a point: note that the slope of the DSLR growth is higher than that of the mirrorless growth. This implies that mirrorless won't overtake DSLRs in sales, as I've been writing for some time now. Mirrorless is a growth market, but it's not a growth market that appears to be cannibalizing DSLR sales.

Now, there are a bunch of caveats involved here. First, the 2013 data point is an estimate, though it is an estimate from the camera company consortium (CIPA). Moreover, these unit volume numbers aren't sales to customers, they're shipments into distribution. We have a lot of hanging inventory sitting around, as all the recent GF3 and GF5 sales have proven.

Panasonic also indicated that they have 17% of the mirrorless market share. For 2013 that means that Panasonic expects to sell into distribution 833,000 mirrorless cameras. If we use Panasonic's further numbers about market penetration as a rough guide, that would imply that Panasonic would ship slightly less than 200,000 cameras into North America this year.

(Aside: the CIPA numbers now show a three-month consecutive decline in mirrorless camera shipments overall; indeed, February's numbers were the lowest number of shipments into distribution since CIPA started tracking mirrorless cameras over a year ago.)

Meanwhile, in terms of overall strategy, Panasonic basically divided their four mirrorless product lines into two: the GF and GX are positioned towards new demand (e.g. compact camera users moving up), while the GH and G are positioned against DSLRs and people who already are using higher end cameras. Nothing new there, though the GX user base may be a little worried about what that line's position really means. Personally, for their low volume, I think four lines is too many for Panasonic. If I were in charge I'd meld the G and GX into a rangefinder with EVF type of product that sits between the GF and GH; what we're seeing is an attempt to rationalize an overly ambitious lineup for how the mirrorless market evolved.