(commentary)

I’ve seen a lot of reporting that goes something like this: Canon and Nikon have been ignoring the mirrorless market and that’s why their DSLR duopoly is in trouble. Trouble, apparently, is defined by those sources as “retaining market share in ILC products during an overall decline in camera sales.”

That’s right, Canon and Nikon are still sitting on the same market shares for ILC products—DSLR and mirrorless combined = interchangeable lens cameras, or ILC—as they have had for some time now. Canon has been at 40-45%, Nikon has been at 30-35%. If one goes up, the other tends to go down the same amount.

Moreover, while the two now control nearly 95% of the DSLR market, they both have mirrorless camera entries, as well. True, they’re a long way from dominating mirrorless cameras, but the combination of stronger DSLR sales and weak mirrorless sales has kept their positions relatively intact overall.

If DSLR sales continue to slip and mirrorless continues to run at the slightly over 3m a year mark, yes, Canon and Nikon will slowly see erosion in their dominance, mostly towards Sony. But Canon and Nikon have really only been “tinkering” in mirrorless so far. It’s difficult to regard the EOS M and the Nikon 1 as anything other than “toes in water.”

What we’re seeing from Canikon is the traditional behavior of the #1 and #2 in a market that is under stress or that is splitting into two. They’ll tend to be slow to act, letting all the other competitors spend R&D money to show them where the sweet spot is.

I think it pretty clear that the sweet spot isn’t a Pen (e.g. small, compact-style mirrorless without EVF). The sweet spot is DSLR-replacement (e.g. X-T1, E-M1, GH4, NX-1, A7). Which means that as long as DSLRs can be marketed as “better” than mirrorless, Canon and Nikon will continue to do so. At the point where mirrorless really is regarded equally to DSLRs, I think you’ll see both Canon and Nikon suddenly appear with competitive mirrorless products. And there’s no doubt in my mind that they can do so.

The doubt is over whether any of the camera makers actually understand what the decline in sales is all about. People are taking more images than ever before, so you’d think that quality image tools would still be selling. Yet it’s clear they’re not.

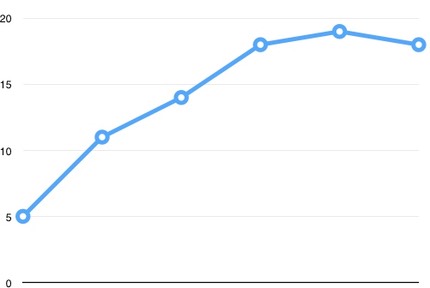

You’ll notice that the pace at which new cameras are introduced, including mirrorless ones, has suddenly cooled.

Mirrorless camera introductions, 2009-2014

More interesting to me were the Q4 shipments of mirrorless cameras the past three years: they’ve dramatically declined (1.4m, 1.1m, 898k), despite the fact that this should be a time when the stores are being stuffed for Christmas sales. DSLR shipments during the same period had the same trend (3.9m, 3.7m, 2.8m). It seems that even Christmas isn’t having the pull on sales that it used to for ILCs, and that’s really bad news, as that’s the biggest selling season for such cameras.

Right now, mirrorless cameras that are resonating with users tend to have a unique gimmick that can be marketed (e.g. EM-5II high resolution mode, GH4 4K video, NX-1 wicked fast frame rates and 4K video, A7 models full frame choice). But none of that is building overall mirrorless sales, let alone something we could call solid growth.

So the current state of the market is this: DSLRs are declining, mirrorless are static. At some point the decline in DSLRs will force Canon and Nikon to get serious about mirrorless and all heck will break loose in the mirrorless market. Prices are going to go down if competition goes up. That’s good for us users, at least temporarily, but it also means that finding profits in the camera market will get more elusive to the camera makers and put them under even more stress than they are.