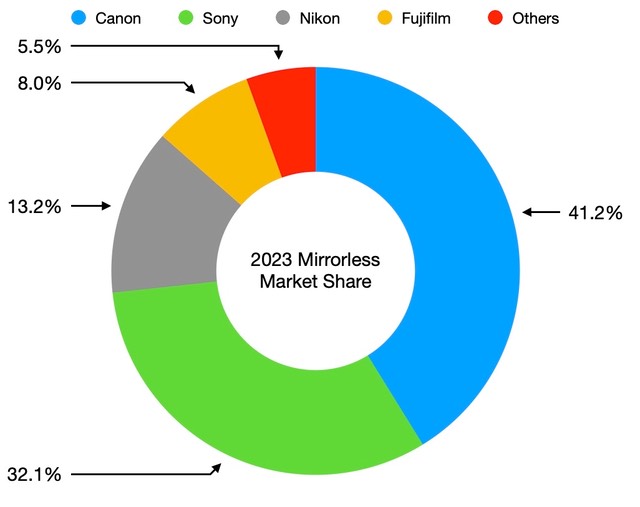

TSR, a Japanese market research company recently reported some basic market share information for mirrorless cameras, which was then summarized by Nikkei (the full report costs thousands of dollars to see):

While these numbers seem to say a number of things, there’s more hidden behind the percentages than you might think.

For instance, Canon is reporting essentially a 50% market share for ILC (interchangeable lens cameras), but only has 41.2% in mirrorless. The discrepancy is that Canon is still selling a fair number of DSLRs, mostly lower cost Kiss/Rebels. Canon’s strength has not fully reestablished itself in the newer mirrorless world.

The opposite is true for Nikon, who reports essentially that they’re somewhere in the mid 13’s for all ILC, which means that they’re holding their own in mirrorless (though this is still far lower than where Nikon was prior to their downsizing in the teens).

Sony, meanwhile, is continuing to benefit from being the first player in full frame mirrorless and having abandoned their DSLR lineup long, long ago. However, their mirrorless market share seems to be no longer growing like it was earlier this decade.

Each of the Big Three have a different problem that isn’t shown in TSR’s numbers, or even in looking at the history of the TSR numbers:

- Canon — Quite a few M series sales are in those numbers for 2023. I’m not sure that the low-end R models are fully replacing the now discontinued Ms. The lowest end R100 is still bigger and more DSLR-like than those M buyers were purchasing. I believe Canon is going to have to use price to make any further gains back towards their 50% market goal as DSLRs completely die off. I don’t know that they can do that without taking a hit to the bottom line, which may explain why there’s so much restructuring going on behind the scenes at Canon.

- Nikon — The good news is that from the Zf on up, Nikon has done a really good job of solidifying their product line, and that's showing up not so much as market share as it is in profits. Nikon’s real problem is two-fold: (1) they have a considerable user base still using DSLRs, and (2) they haven’t reallly shown how the bottom of the lineup will feed the top long-term. Coupled with Canon’s likely need to lower prices at the low-end, Nikon will have a harder time pushing Z30, Zfc, and Z50 models, so something has to change there.

- Sony — The tricky part in evaluating Sony’s market share comes in Sony’s recent heavy push towards “content creator” cameras such as the EV’s and A7C’s. Much of Sony’s volume previously came from A6### and the three A7 models. That's now shifted, but that introduces the question of how often the new group Sony is pursuing is going to update. The thing is that even 4K is a low bar, and most of the creators are more concerned with speed-to-post than they are highest-possible-quality.

The irony is that traditional MBA-think is that the rule of thumb is that the top two market share holders are highly profitable, the third marginally profitable, and the rest not profitable. Right now things seem to be completely upside down. Nikon appears to be making the highest gross profit margin off cameras, and Canon the least. That’s usually predictive of a future shift in respective shares.

Underlying all of this is the size of the overall market. Since 2020’s bottom (2.9m), mirrorless once again started growing again in unit volume, and is up to 4.8m units in 2023. I believe DSLRs will completely wind down by early 2025, so the potential is there for something around 6m mirrorless units in 2025, or 100% growth in essentially five years.

The big problem is envisioning any growth after that. Which means that this year and next are duke-it-out years to try to establish the top players before the next plateau in sales hits. Again, at the moment it seems that Canon can only make gains using pricing, while Sony is making gains by shifting users; leaving the only one of the Big Three to be Nikon with a chance to make big share changes naturally. (To wit: Nikon’s lineup needs updating now exactly in the range that would promote market share, Z30 up to Z5.)

The Japanese companies have proven quite adept at micromanaging their way through tough markets such as cameras. To a large degree, that was also due to a relatively stable currency and near zero interest rates that made corporate borrowing and stock dividends the easiest ways for Japanese banks to make money, even at low interest rates.

However, both those things are under huge stress at the moment. The yen/dollar relationship is now well outside of its historical range, and as inflation has returned to Japan, interest rates will have to change upwards, too.

The ILC market is still Canon’s to lose, but more than any time since the original DSLR introductions, it’s easier to see them losing it. Sony has a proliferation problem they need to reign in; they’ve tried to niche a niche market, plus keep older models still on the market to give them the appearance of lower pricing. We’ve seen how this plays out in the camera market before: you’re better off with a smaller, strong core of products that you can clearly move forward in (near) unison. Nikon has shored up things with their best customers with the top of the lineup, but that still leaves a ton of previous customers they’re not serving satisfactory.

My sense is that, depsite the relatively large current market share differences, it’s still a wide open market for someone to make substantive moves. Again, the 2023 mirrorless volume was 4.8m units and it’s pretty easy to predict something around 6m units in 2025. That’s a pretty big increase to be fighting over, and I think we’re going to see some massive fights over it Real Soon Now.

I don’t see Sony’s overall share changing all that much. Both their proliferation and older model discounting have essentially maximized their market share penetration, and those are not sustainable strategies. I can see Canon’s share slipping, though. Which leaves Nikon and Fujifilm to pick up not only that share but grab some of those new customers implied in the ramp from 4.8 to 6m units.

That would actually be good news. Well, maybe not for Canon. A tighter market share race would force the camera companies to be more competitive and to design products that have differentiated and useful features.