News/Views

Are Market Shares Meaningful?

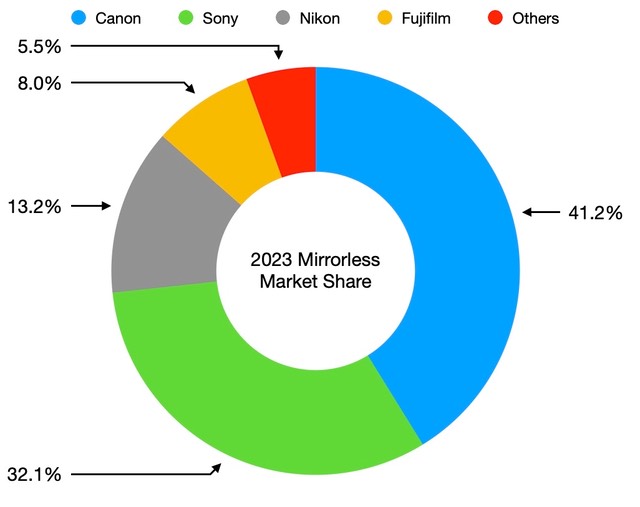

TSR, a Japanese market research company recently reported some basic market share information for mirrorless cameras, which was then summarized by Nikkei (the full report costs thousands of dollars to see):

While these numbers seem to say a number of things, there’s more hidden behind the percentages than you might think.

For instance, Canon is reporting essentially a 50% market share for ILC (interchangeable lens cameras), but only has 41.2% in mirrorless. The discrepancy is that Canon is still selling a fair number of DSLRs, mostly lower cost Kiss/Rebels. Canon’s strength has not fully reestablished itself in the newer mirrorless world.

The opposite is true for Nikon, who reports essentially that they’re somewhere in the mid 13’s for all ILC, which means that they’re holding their own in mirrorless (though this is still far lower than where Nikon was prior to their downsizing in the teens).

Sony, meanwhile, is continuing to benefit from being the first player in full frame mirrorless and having abandoned their DSLR lineup long, long ago. However, their mirrorless market share seems to be no longer growing like it was earlier this decade.

Each of the Big Three have a different problem that isn’t shown in TSR’s numbers, or even in looking at the history of the TSR numbers:

- Canon — Quite a few M series sales are in those numbers for 2023. I’m not sure that the low-end R models are fully replacing the now discontinued Ms. The lowest end R100 is still bigger and more DSLR-like than those M buyers were purchasing. I believe Canon is going to have to use price to make any further gains back towards their 50% market goal as DSLRs completely die off. I don’t know that they can do that without taking a hit to the bottom line, which may explain why there’s so much restructuring going on behind the scenes at Canon.

- Nikon — The good news is that from the Zf on up, Nikon has done a really good job of solidifying their product line, and that's showing up not so much as market share as it is in profits. Nikon’s real problem is two-fold: (1) they have a considerable user base still using DSLRs, and (2) they haven’t reallly shown how the bottom of the lineup will feed the top long-term. Coupled with Canon’s likely need to lower prices at the low-end, Nikon will have a harder time pushing Z30, Zfc, and Z50 models, so something has to change there.

- Sony — The tricky part in evaluating Sony’s market share comes in Sony’s recent heavy push towards “content creator” cameras such as the EV’s and A7C’s. Much of Sony’s volume previously came from A6### and the three A7 models. That's now shifted, but that introduces the question of how often the new group Sony is pursuing is going to update. The thing is that even 4K is a low bar, and most of the creators are more concerned with speed-to-post than they are highest-possible-quality.

The irony is that traditional MBA-think is that the rule of thumb is that the top two market share holders are highly profitable, the third marginally profitable, and the rest not profitable. Right now things seem to be completely upside down. Nikon appears to be making the highest gross profit margin off cameras, and Canon the least. That’s usually predictive of a future shift in respective shares.

Underlying all of this is the size of the overall market. Since 2020’s bottom (2.9m), mirrorless once again started growing again in unit volume, and is up to 4.8m units in 2023. I believe DSLRs will completely wind down by early 2025, so the potential is there for something around 6m mirrorless units in 2025, or 100% growth in essentially five years.

The big problem is envisioning any growth after that. Which means that this year and next are duke-it-out years to try to establish the top players before the next plateau in sales hits. Again, at the moment it seems that Canon can only make gains using pricing, while Sony is making gains by shifting users; leaving the only one of the Big Three to be Nikon with a chance to make big share changes naturally. (To wit: Nikon’s lineup needs updating now exactly in the range that would promote market share, Z30 up to Z5.)

The Japanese companies have proven quite adept at micromanaging their way through tough markets such as cameras. To a large degree, that was also due to a relatively stable currency and near zero interest rates that made corporate borrowing and stock dividends the easiest ways for Japanese banks to make money, even at low interest rates.

However, both those things are under huge stress at the moment. The yen/dollar relationship is now well outside of its historical range, and as inflation has returned to Japan, interest rates will have to change upwards, too.

The ILC market is still Canon’s to lose, but more than any time since the original DSLR introductions, it’s easier to see them losing it. Sony has a proliferation problem they need to reign in; they’ve tried to niche a niche market, plus keep older models still on the market to give them the appearance of lower pricing. We’ve seen how this plays out in the camera market before: you’re better off with a smaller, strong core of products that you can clearly move forward in (near) unison. Nikon has shored up things with their best customers with the top of the lineup, but that still leaves a ton of previous customers they’re not serving satisfactory.

My sense is that, depsite the relatively large current market share differences, it’s still a wide open market for someone to make substantive moves. Again, the 2023 mirrorless volume was 4.8m units and it’s pretty easy to predict something around 6m units in 2025. That’s a pretty big increase to be fighting over, and I think we’re going to see some massive fights over it Real Soon Now.

I don’t see Sony’s overall share changing all that much. Both their proliferation and older model discounting have essentially maximized their market share penetration, and those are not sustainable strategies. I can see Canon’s share slipping, though. Which leaves Nikon and Fujifilm to pick up not only that share but grab some of those new customers implied in the ramp from 4.8 to 6m units.

That would actually be good news. Well, maybe not for Canon. A tighter market share race would force the camera companies to be more competitive and to design products that have differentiated and useful features.

Canon's Big Day

Today Canon announced the US$4300 R5 II and officially launched the US$6300 R1. These are two of top three cameras in the RF lineup—the R3 is the other—so Just as Nikon did earlier with their Z8/Z9 combo, Canon is making a strong new statement about the top of their camera lineup.

The star of the early morning (in the US) press release salvo is clearly the R5 II, so let’s start with that.

What's New in the R5 II?

The big news here is all internal, as Canon has focused on making technology changes at the heart of the camera. Pixel count and basic body bits don’t change.

The biggest internal change is the move to a stacked BSI CMOS image sensor, which provides up to 30 fps, though with rolling shutter. Initial reports put the R5 II’s rolling shutter impact about halfway between the Nikon Z6 II and the Nikon Z8/Z9. I’m hearing something close to 1/160 (the Z8/Z9 is slightly greater than 1/250, and the Z6 III is about 1/70). Curiously, this new fast imaging chain doesn’t save bit depth data, like the original R5 did.

Eye Control in the viewfinder for directing focus has now made it’s way down to the R5 II (it’s in the R1 and R3). Like the R1, the R5 II gets the DIGIC Accelerator chip to help handle real time focus decisions, including those new Action Priority focus modes (for soccer, basketball, and volleyball), as well as being able to recognize people you’ve pre-registered with the camera (up to 10 sets of 10 people). Pre-capture also makes its way to the R5 II.

Many of the gains for the new camera come on the video side, including better heat management, including a new 4K SRaw video mode that’s full frame oversampled.

How's the R1 differ from the R3?

Again, the news is mostly about internal technology changes, though the R1 body is bigger than the R3. Here, everyone is mostly looking at how the R1 exceeds or improves the R3, though. That happens primarily in the focus system: the first quad-pixel mirrorless arrangement gives the R1 better focus discrimination on the vertical axis. A new Action Priority focus mode appears in the R1 (and also the R5 II) (I wish I had a dime for every time I’ve typed the word mode in my long career of documenting cameras). To achieve some of the advances, there’s a second DIGIC Accelerator chip in the camera.

While the image sensor is still just 24mp, the viewfinder jumps to 9.44m dots, with a 0.9x magnification. The mechanical shutter goes to 12 fps, the electronic to 40 fps. The image sensor is stacked, so rolling shutter is highly improved, but it’s unclear exactly by how much as I write this.

Video gets some boosts, with 6K/60p being the maximum capability. Dual CFexpress Type B cards help keep the card keeping up with the high data rates.

One thing that is already a discussion factor among pros is whether the Canon professional would be better off with the R1 or R3. I haven’t had a chance to use the former, so can’t really say. But Canon’s press release announce of the R1 didn’t really shine where it comes to making that decision. Of course, most of us don’t have to make that decision until fall 2024, as the R1 is being announced pre-Olympics, but won’t be available to the general public until much later.

Overall…

Only the R5 II was available to most media outlets prior to the launch, which is why you’re seeing so much more information about it today. Technically, it’s the more important camera, and Canon has badly needed to achieve parity with the Nikon Z8 ever since that camera appeared. For the most part, it seems that they’ve done that, and has managed to get a teeny bit past the Nikon frog in their jump. One way that Canon did better this time is in the accessory bits, where Nikon still doesn’t have additional hotshoe communication, or grips with Ethernet support built in.

But the timing and manner in which Canon made these launches seems meek. Basically, the announcements were made outside of business hours in Japan (7pm), the United States (3 to 6am), with only Europe getting mid-day announcements (and right at lunch time in, say, Paris). Those are not what I’d call “strong launch times,” where you can completely get people’s attention. Of course, given that neither camera will be available to the public prior to sometime in August (or later in the case of the R1), maybe Canon’s saving their ammunication for after the Olympics.

Still, it seems odd to me to announce major products this way.

Meanwhile...

Canon executives said the following in a recent press interview overseas: "there are...lenses with specifications that have never been seen before and that no one can imagine yet. We would like to develop those." My question about that is whether or not Canon has enough insight with photographers any more to develop lenses that haven't existed before, and that once the public discovers what Canon creates, will want them. I suspect instead that Canon is looking for "halo" products, ones that they can point to and say "see, we're leading."

The mantra among customers these days is "smaller and lighter." That comes from a number of areas, including an aging core base, airline and venue restrictions, and even the whole notion of not looking like a geek with a tech shop on their back and hanging from straps.

The Canon RF 28-70mm f/2L was one of those "haven't existed before" lenses. It's also over three pounds in weight and more expensive than most Canon cameras. I've seen a few pros pick this one up and then begin complaining about things (95mm filters, size/weight hanging off the front of lighter body, etc.). The thing about making something completely new is that, for it to really be meaningful in the market, it has to delight users. I'm skeptical about this.

I mentioned that I wasn't sure that I'm not sure that Canon has enough insight to what the photographers are actually doing and asking for. This month CanonUSA made a large set of layoffs and buyouts, including apparently, Rudy Winston, someone I've had the pleasure of interacting with and learning from. After Chuck Westfall died, Rudy was sort of a go to for both pros and media to get useful information here in the US.

Petapixel has published a response from Canon about the layoffs (and again, many if not most were people accepting a Canon buyout offer, not actually being terminated by the company): "Canon's recent reorganization was made to streamline operations and promote efficiency, in order to help achieve the necessary levels of performance that are required to meet our targets and remain competitive in a fast changing industry." This is corporate speak for "by eliminating employees we save money; we'll just make everyone left work harder."

I've written the following for almost all my career: when companies cut back on key knowledgable personnel that were effective in creating things or working directly with customers, they lower the quality they provide their customers. Lower the quality, and over time you'll lower your sales. Lower your sales, and you'll be downsizing again in the future. It's a death spiral if you think this is the plan to execute ad infinitum.

Canon's new cameras look good. However, they're at the top of the lineup where you actually need more people to help train and support those buying the cameras, not less. One of the things about Rudy was that, when I came to him with a narrow knowledge of a few Canon offerings, he was able to put that in context of the full lineup for me and show me things I either hadn't understood or had completely missed. I wonder who's going to do that for me tomorrow?

The Sony APS-C Vlogger Gets Updated

Sony today announced the ZV-E10 II, a modest update to the original. The big news here is the use of the same 26mp image sensor as the A6700 and FX30 and dropping the mechanical shutter. The body also undergoes a bit of a bulk to accommodate the larger NP-FZ1000 battery.

The new sensor provides 1.1x crop 4K/60 derived from downsampled 5.4K (and with 10-bit depth), and Sony has added things like vertical video support (with the LCD moving the overlays into the correct positioning). There are also 2:35:1 widescreen and cropped 4K/120 modes, as well.

Because this is an entry body, there's no sensor-stabilization, though video can be actively stabilized by using a ~1.5x crop (a 1.33x crop of the 1.1x crop). The ZV-E10 Mark II also doesn't get the latest BIONZ AI improvements, though at the US$1000 price point that is to be expected.

Along with the ZV-E10 Mark II, Sony also updated the 16-50mm f/3.5-5.6 OSS lens to a II model. The big difference here other than cosmetics and a bit of weight loss is that focus can now track while the lens is zooming. That's sort of a big deal for vlogging ;~)

Strangely, Sony has dropped the "Mark" from what usually would be "Mark II" and gone with the simpler roman numeral only that Nikon and Panasonic have been using.